Financial Planning for Gig Economy Workers and Freelancers: Your Blueprint for Stability

The freedom is intoxicating. You’re the captain of your own ship, choosing your projects, setting your hours, and escaping the 9-to-5 grind. But let’s be honest—that freedom comes with a side of financial vertigo. No steady paycheck. No employer-sponsored 401(k). No company health insurance.

Your income probably looks more like a mountain range than a flat plain—peaks of plenty and valleys of… well, let’s just say lean times. Navigating this terrain without a map is a recipe for stress. But here’s the deal: with a tailored financial plan, you can build a foundation so solid that the ups and downs feel less like a rollercoaster and more like a manageable path. Let’s build that foundation, together.

Taming the Irregular Income Beast

This is, without a doubt, the biggest hurdle. You can’t budget like a salaried employee when your income is a moving target. The old rules don’t apply. So, we need a new system.

The “Pay Yourself a Salary” Method

Think of your business income and your personal money as two separate entities. Here’s a simple way to make that happen:

- Open Two Bank Accounts: One main business account where all client payments land, and a second personal checking account for your “salary.”

- Calculate Your Baseline: Figure out the absolute minimum you need to cover your monthly living expenses. Be ruthless here—housing, utilities, groceries, debt minimums.

- Schedule a Monthly “Payday”: On a set date each month, transfer that baseline amount from your business account to your personal account. That’s your salary. No more, no less.

This single habit creates an artificial, but incredibly effective, steady paycheck. It forces you to smooth out the cash flow chaos.

Building Your Financial Shock Absorbers

That money left in your business account? It’s not for a splurge. It has two critical jobs. First, it pays your business expenses and taxes (more on that later). Second, and just as important, it funds your emergency buffer.

For freelancers, an emergency fund isn’t a nice-to-have; it’s a non-negotiable survival tool. While the standard advice is 3-6 months of expenses, aim for 6-9 months as a gig worker. This cushion covers you for slow periods, unexpected dry spells, or a laptop deciding to die a sudden death.

The Tax Tango: Don’t Get Caught Off Guard

Ah, taxes. The part everyone loves to ignore until April rolls around with a nasty surprise. When you’re self-employed, you’re responsible for paying your own income tax and self-employment tax (that’s the Social Security and Medicare your employer used to cover).

A good rule of thumb is to set aside 25-30% of every single payment you receive. Immediately. Transfer it to a separate, high-yield savings account labeled “TAXES.” Do not touch it. It was never yours to begin with.

And since you don’t have an employer withholding tax, you’ll likely need to make quarterly estimated tax payments to the IRS. It’s like paying your tax bill in four installments throughout the year. Missing these can lead to penalties. A good accountant who understands freelance finances is worth every penny—they can help you navigate deductions you might not even know about, from home office costs to a portion of your internet bill.

Retirement: Your Future Self Will Thank You

No company pension? No problem. You have powerful options, honestly, that can sometimes be even better than a traditional 401(k).

- SEP IRA: Simple to set up and manage. You can contribute up to 25% of your net earnings, up to a pretty high limit.

- Solo 401(k): This is the powerhouse. It often allows for higher contributions than a SEP IRA, especially if you’re under 50.

- Traditional or Roth IRA: A great starting point or supplement, with an annual contribution limit of several thousand dollars.

The key is to automate it. Set up a monthly transfer from your business account to your retirement account, even if it’s just $50 or $100 to start. Make it a non-negotiable business expense, just like your software subscriptions.

Protecting Yourself: The Insurance Puzzle

This is where many freelancers feel exposed. You’re one accident or illness away from a major financial setback. Let’s break down the essentials.

| Type of Insurance | Why It’s Crucial for You |

| Health Insurance | Non-negotiable. Explore the Affordable Care Act marketplace, professional associations, or joining a spouse’s plan. |

| Disability Insurance | Your most valuable asset is your ability to work. This replaces a portion of your income if you’re too sick or injured to do your gig. |

| Business Liability / E&O | If you’re a consultant or provide advice, Errors & Omissions insurance protects you if a client sues over your work. |

| Life Insurance | Essential if anyone depends on your income. |

Beyond the Basics: Leveling Up Your Financial Game

Once you’ve got the core systems in place, you can start thinking strategically. This is where you move from surviving to truly thriving.

Diversify Your Income Streams. Don’t put all your eggs in one client basket. Actively seek a mix of retainer work, one-off projects, and maybe even a passive income stream—like a digital product or a course related to your skills. This makes your income more resilient.

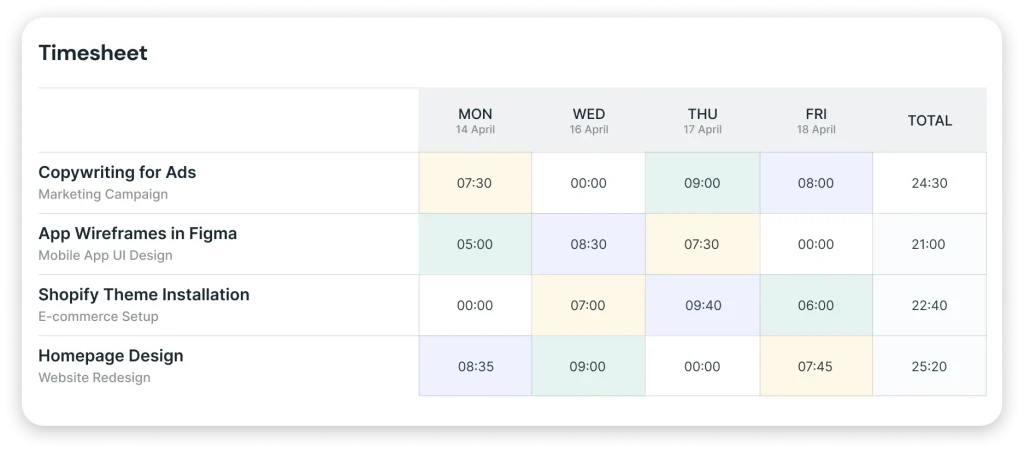

Track Your Time and Value Accurately. Are you actually making a profit on that project after accounting for all the unbillable hours spent on admin and emails? Use time-tracking tools to understand your real hourly rate. Then, start pricing based on the value you deliver, not just the hours you log.

Invest in Your Skills. The gig economy is competitive. Allocate a portion of your income for professional development. A new certification or mastery of an in-demand software can be the tide that lifts all your income boats, allowing you to command higher rates.

The Mindset of a Financially Secure Freelancer

All these strategies are just tactics. The real shift is mental. It’s about embracing the CEO mindset. You are no longer just the talent; you are the head of finance, sales, and operations for “You, Inc.” This perspective changes everything. It turns financial planning from a chore into a strategic exercise in building the life you want—on your own terms.

The freedom of the gig economy is real. But the truest freedom of all? It’s the freedom from financial anxiety. It’s knowing that you’ve built a system that can withstand the storms and celebrate the sunny days. That your ship is not just afloat, but sailing confidently toward a horizon of your own design.